Deriving the Mortgage Payment Formula

Presenting how the formula for monthly mortgage payments is mathematically derived from the definition of an annuity loan.

financemortgagepaymentexcelmathI'll show you how to derive the mortgage formula for monthly payments:

where

For example, for a 30 year $500,000 mortgage, with a fixed annual interest rate of 6%, we'd have:

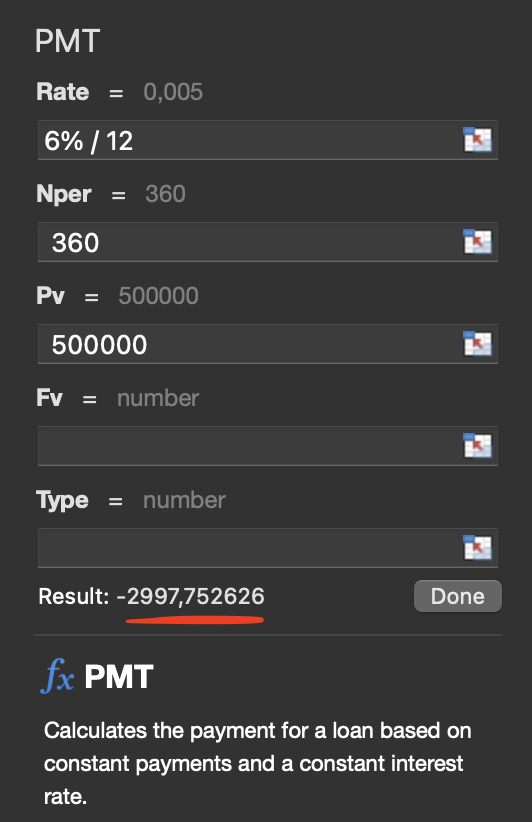

Which means that the described mortgage incurs monthly payments of $2,997.75.

This number corresponds with Microsoft Excel's built-in PMT function.

So let's see where this formula comes from.

Table of Contents

Annuity Loan Characteristics

We'll be looking at so-called annuity loans, which are characterised by the following properties:

- The loan starts out by lending a certain amount of money, denoted for principal amount

- The lender is expected to pay back this loan in a fixed number of equal payments, for some natural number

- Such payments are called annuities, where the annuity amount, denoted , remains constant throughout the loan, and always consists of two components:

- interest

- principal repayment

- The interest component varies month-to-month, because it's calulated by multiplying an agreed-upon fixed interest rate (greater than zero) with the remaining principal (i.e. the original principal amount minus all previous principal repayments)

- The principal repayment varies month-to-month as well, in such a way that the annuity remains constant for the entire loan duration

After making annuity payments of exactly dollars (euro's, pounds, whatever), your loan will be completely paid off. Put differently: the principal repayment component of each of those annuities will add up to your original principal amount .

Below you'll find a typical loan repayment diagram with 12 annuities, showing how the monthly annuity remains constant from start to finish.

The sum of all blue bars is equal to .

This diagram also shows that the total amount of interest can easily surpass the principal payment amount , depending on the interest rate .

Take our 30 year mortgage from the introduction, for example. We calculated that a $500,000 principal at an annual interest rate of 6% corresponds to a monthly annuity of $2,997.75. So when you've paid off your mortgage after making 360 of these $2,997.75 payments, you would've paid the bank a grand total of $1,079,190, consisting of the $500,000 principal and $579,190 of interest.

It's good to be a bank 🙂

Principal Payment Formula

The main goal of this article, is to find a formula for the monthly annuity amount .

In preparation, we'll start by studying the following sequence

with defined as the remaining principal after making annuity payments.

From this, it immediately follows that .

But what is ? In other words: how much do we owe the bank after making our first annuity payment?

Well, since the annuity amount remains constant throughout the loan's entire duration, this first payment has reduced our loan principal by some amount less than :

- the interest component of this first payment is equal to

- the remaining part of is principal reduction, i.e.:

In other words:

We can capture this notion in a more general sense.

The remaining principal after making a total of annuity payments is equal to the previous remaining principal minus the principal repayment component of the -th annuity:

This recursive identity for in terms of will eventually give us a formula for .

Proposal for a Non-recursive Identity

So, how can we turn this recursive identity into a single, non-recursive formula for ?

It usually helps to write out the first few terms, to see if a pattern can be detected.

From this, it seems like the following pattern is beginning to emerge:

Please note that this formula is just a guess at this point. We'd have to actually prove that this formula satisfies the recursive identity from the previous chapter.

But if the formula above were correct, that would be great, because we recognise the last term in this expression as the geometric sum:

for any .

So we can let because was assumed to be greater than zero, and reformulate our proposal for the formula.

Now, as a special case, note what happens if we let :

This suggests that we can actually put forward a single proposal for the formula, which should allow us to calculate the remaining principal after making annuity payments, for any with :

Proof for the Non-recursive Identity

We set out to find a simple formula for which would satisfy the following recursive identity:

Then, in the previous section, we put forward the following proposal:

But we still need to prove that our proposal indeed satisfies the recursive identity. We'll do so by checking whether the expression indeed equals .

Here we go:

This concludes the proof that our proposal for is indeed correct.

Annuity Payment Formula

We've proven our formula for the remaining principal after making annuity payments:

Let's rephrase this equation to find an expression for :

Now, even though the symbol appears in the formula for , we know that it's actually independent of . Because it doesn't matter how many payments you've made, the annuity remains constant from start to finish. As noted before, this is a defining characteristic of annuity loans.

This means that if we knew of a particular and its corresponding value, we could simply plug those into the formula above, and simplify the expression in such a way that the symbol no longer occurs.

One such is , corresponding to . But we've already used this fact when defining the recursive relation for in terms of . Attempting to use this fact for a second time doesn't yield anything useful:

But there's another we can use!

Remember how one of the characteristics of an annuity loan, is that it's completely paid off after making payments. This implies that corresponds with .

Plugging these values into our formula for yields the following result:

where

Monthly vs. Annual Interest Rates

Let's take a moment to dive into a little detail of the formula we have just derived:

But what are and , and how are they "linked" exactly?

- The number refers to the total number of payments you'll be making during the loan's duration

- The number refers to the interest rate that's being multiplied with the total remaining principal, in order to determine the interest component for the upcoming payment

For example, in case of a 30 year mortgage, you'll be tempted to set , but that would only be true when paying your mortgage once per year, rather than monthly.

Under normal circumstances, you'd set , corresponding with the number of monthly mortgage payments.

As for the interest variable, you'll be tempted to set in case of a mortgage with a fixed 6% annual interest and 360 monthly payments, but that would only be true if 6% were the monthly interest rate, rather than the annual interest.

An annual interest rate of 6% means that you're expacted to pay the bank 6% of the remaining principal, once per year.

And so this 6% doesn't really apply to a typical mortgage with monthly payments.

In order to apply our 6% annual interest rate to a monthly payment schedule, we must somehow spread this single annual interest payment over 12 separate months.

This is done by dividing the annual interest rate by 12 in order to convert it into a monthly interest rate.

This brings us to the final formula of this article, which can be used for determining the monthly payment amount for a mortgage with a fixed interest rate.

where